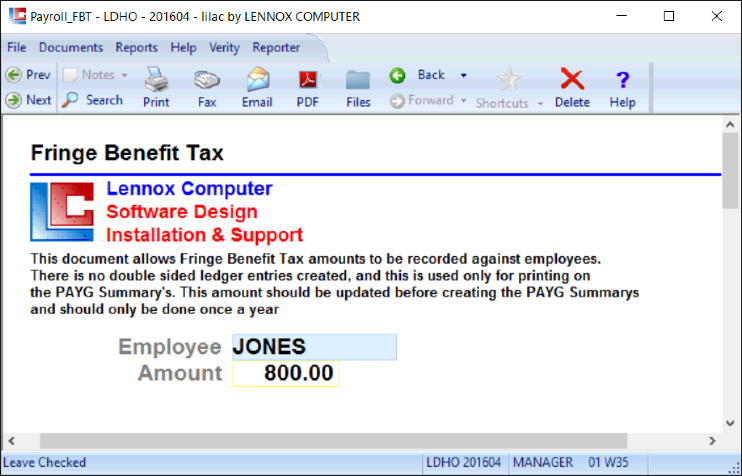

Payroll FBT

Purpose: This document allows the user to type in the Fringe Benefit Tax amount which is to appear on the PAYG summary for the employee.

Prerequisites: Employee Master Records should have been created via the Payroll - Create Employee document.

Context: Fringe Benefit Tax (FBT) is a taxation benefit provided to employees. In broad terms, fringe benefits are payments to employees other than salary and wages.

NOTE: This document does not create double ledger entries. It should only be used to display the actual fringe benefit tax amount on the employee's PAYG summary.

NOTE: Entering the FBT is not required to run a PAYG Summary report. It is however the only way of displaying the FBT amount on a PAYG Summary.

Employee: Type in the employee’s key (or click the right mouse button) and select the key from the list.

Amount: Type in the total FBT amount (in whole dollars) for the year for the selected employee.

From Here: After the Fringe Benefit Tax has been entered for a particular employee, you can run a PAYG Summary report for that employee.